If it weren’t for Elliott Management of the US, Milan’s CEO Giorgio Furlani says the club would have collapsed financially.

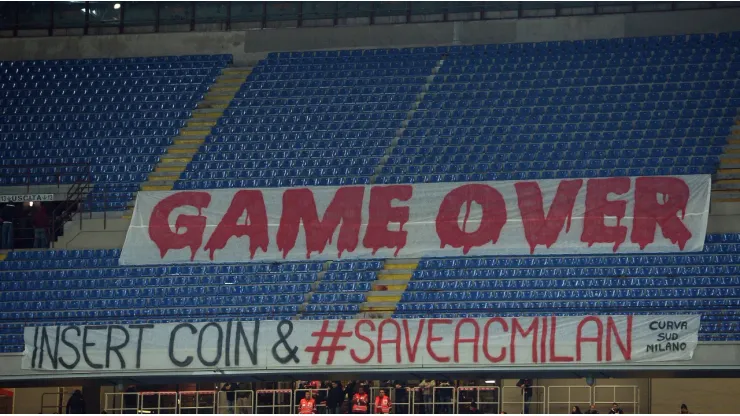

When Silvio Berlusconi sold the Rossoneri to Yonghong Li, they plummeted into anarchy after more than 30 years under the now-late Italian mogul. The shrouded Chinese billionaire finalized the deal only with the help of a loan from Elliott Management.

However, the US trust fund effectively took control of the Serie A club when he failed to repay it. Last year, RedBird, led by Cardinale, purchased the bulk of the company’s shares with the club in good financial health.

Several challenges arose when they acquired the San Siro outfit. Examples include the Growth Decree’s repeal and the stadium bureaucracy. Yet, Milan are back in the black for the fiscal year of 2022-23 and looking good.

What did Milan CEO say about American owners?

In a recent interview with Fortune Italia, Giorgio Furlani discussed the development of AC Milan. The 45-year-old also voiced his opinions regarding Italy’s systemic problems.

“After difficult years, the recovery and relaunch of this club, which represents the history of Italian football worldwide, were made possible by our previous ownership, which prevented the disaster of bankruptcy. Today, we are experiencing a phase of acceleration and growth.

“We are in a new important chapter in the Club’s evolution, supported by Gerry Cardinale’s strategic vision, RedBird’s skills and experience in the business sports, media and entertainment, developing global brands and creating virtuous synergies. We have started a fundamental growth path to close the gap with the big teams in Europe, especially those in the Premier League, which today have higher revenues.

“Sporting success has to be at the core of the AC Milan project. The revenue that is generated is re-invested in the Club: investment in players, but also in facilities, infrastructures, commercial capabilities and people. It’s a virtuous circle: revenues fuel investments, which produce better performances, which in turn create new revenues.

“Ownerships, especially foreign ones, are willing to invest in new stadiums. There has been, however, a de facto impossibility due to bureaucratic and administrative complexity. There is a will and there is capital, but it’s hard to invest.”

What did Milan CEO say about problems in Italy?

His remarks made it quite evident that soccer is more than just a pastime; it’s an enterprise. “We must abandon the idea that football is a game and nothing else. Football is an industry.

“We are talking about clubs that have hundreds of millions of Euros in revenue and can bring hundreds of millions of investments into our country. Football is an extraordinary instrument to attract capital and participate in the growth of the country’s GDP.

“There are systemic problems in Italy, among them the sporting infrastructure that is embarrassing, to use a euphemism. We have serious problems of piracy in television. Plus there is a series of rules and laws that do not help us be competitive on a European level.

“So, if we all want to incorporate this large chunk of the economy into the wider country’s financial structure, we need to collaborate in synergy.”

Photo credits: IMAGO / Gribaudi/ImagePhoto : IMAGO / sportphoto24

200+ Channels & Local Sports

- Price: Plans starting at $14.99/mo (Latino)

- Watch Ligue 1, Copa Libertadores & World Cup Qualifiers

Every MLS Match in One Place

- Price: $12.99/mo (Now included with standard subscription)

- Watch every MLS regular season game, Playoffs & Leagues Cup

Many Sports & ESPN Originals

- Price: $11.99/mo (or ESPN Unlimited for $29.99/mo)

- Features LaLiga, Bundesliga, FA Cup & NWSL

2,000+ Soccer Games Per Year

- Price: Starting at $8.99/mo

- Features Champions League, Serie A & Europa League

Home of the Premier League

- Price: Starting at $10.99/mo

- 175+ Exclusive EPL matches per season