Premier League struggling giants Manchester United have received investment from American hedge fund billionaire Leon Cooperman. The ownership of Manchester United continues to be a subject of significant scrutiny and attention.

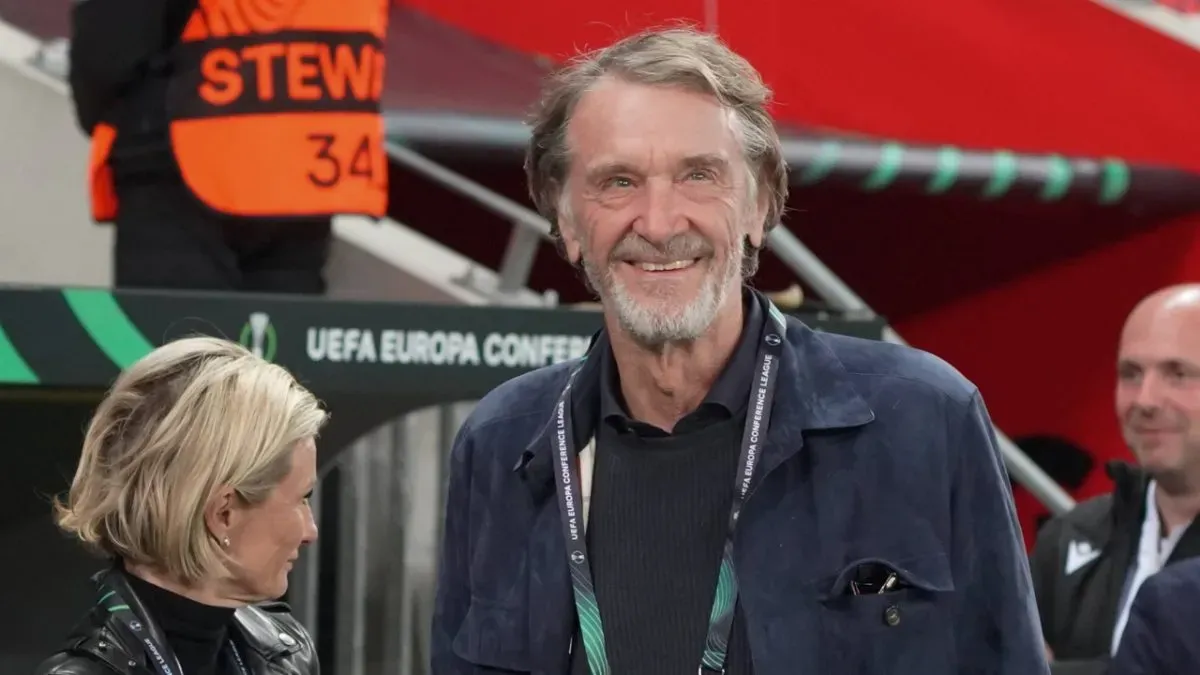

United is nearing the completion of an agreement with British businessman Sir Jim Ratcliffe. Ratcliffe will be a minority partner at Old Trafford with 25% ownership of the club. The hope at the club is to finalize the contract during the November international break.

In a significant development last November, the Glazer family disclosed its intention to sell Manchester United. This came at the same time Cristiano Ronaldo said he would leave the club. After lengthy delays, Ratcliffe stepped in for his partial takeover of the club. The CEO of INEOS is paying $1.5 billion for that 25% share.

He had been engaged in a takeover dispute with Qatar’s Sheikh Jassim. Both sought to gain control from the American Glazer family. The Americans have held majority ownership in United since 2005. In September, Bloomberg disclosed that Ratcliffe was reorganizing his bid. He, like Sheikh Jassim, hit an impasse with the Glazers in a potential takeover.

Ratcliffe’s ownership stake in United, even though it is not a full takeover, has fans hoping for a turnaround.

What Leon Cooperman brings to Manchester United

Now a fresh investment has been made. The market interpreted this as more evidence that the club would finally sell a controlling stake to Ratcliffe.

Controversial American billionaire investor Leon Cooperman acquired more than 900,000 shares in the Red Devils. The 80-year-old Cooperman has reportedly invested almost $18.4 million on exactly 929,078 shares of United, Forbes revealed.

Cooperman’s investment looks to be part of a trend, even if his stake in the legendary soccer club is not large enough for him to have a say in who plays for the club on game day. To prepare for Ratcliffe’s takeover from the very unpopular Glazer family, hedge funds have been buying up large blocks of Manchester United shares.

These funds include Psquared Asset Management AG (which purchased a stake worth around $24.5 million), Antara Capital ($30 million), and Eminence Capital ($17 million).

Since establishing the Omega Advisors hedge fund in 1991, Leon Cooperman has amassed a real-time net worth of $2.8 billion, making him the 1,099th wealthiest person on the planet. He has pledged to donate the majority of his wealth and has begun transferring his holdings to a nonprofit organization.

Glazers remain in the fold

In 2005, the family of late industrialist Malcolm Glazer purchased the majority stake (98 percent) in the English soccer superpower for a reported $1.4 billion. They inherited a troubled business, and their tenure as owners has been nothing short of chaotic.

The trouble began on their first visit to Old Trafford, when irate supporters greeted them, and they had to be led out in a police vehicle. In 2012, the family made the club’s shares available to the public by listing them on the New York Stock Exchange. Now, the anticipated agreement with Jim Ratcliffe is poised to retain the Glazers in a certain degree of control.

PHOTOS: IMAGO.